Dealing with hundredweights (CWT) in commodity trading often leads to confusion and costly errors. Different regions and contracts use varying definitions (100 pounds versus 112 pounds), creating significant pricing discrepancies. This instructional guide provides a step-by-step approach to using CWT calculators for accurate pricing, minimizing risks, and maximizing profitability.

Understanding the Hundredweight (CWT) Nuances

The hundredweight (CWT), a unit of weight frequently used in commodity trading, simplifies pricing calculations for bulk goods. However, a CWT isn't universally defined. In some contexts, it represents 100 pounds; in others, it's a "long hundredweight" of 112 pounds. This inconsistency creates a major challenge in international commodity trading. Failing to account for this difference can lead to substantial financial losses.

Why Use a CWT Calculator?

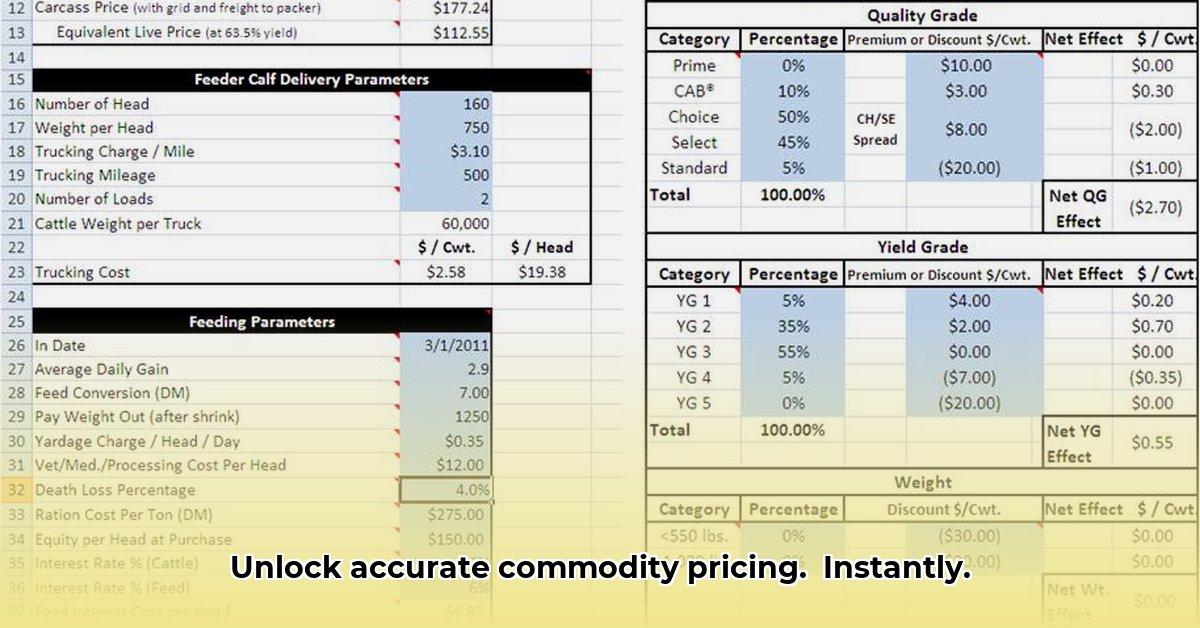

Manually calculating costs for large commodity shipments, considering varying weight definitions, is time-consuming, error-prone, and inefficient. A CWT calculator automates this process, saving time and reducing costly mistakes. It ensures consistent and precise pricing regardless of the CWT definition used. But choosing the right calculator is crucial.

Selecting and Using a CWT Calculator: A Step-by-Step Guide

Here's how to effectively use a CWT calculator to ensure accurate commodity pricing:

Identify a Reliable Calculator: Numerous online CWT calculators exist. Choose one with a user-friendly interface, positive user reviews, and features accommodating both 100-pound and 112-pound CWT definitions. Look for calculators from reputable sources in the commodity trading industry.

Accurate Weight Input: Enter the total weight of your commodity in pounds. Precision is critical here; even a small error can significantly affect the final price.

Specify CWT Definition: This is the most crucial step. Select whether you're using a 100-pound or 112-pound hundredweight, precisely matching the contract specifications.

Enter Price per CWT: Input the agreed-upon price per hundredweight (as clearly defined in your contract). Verification is essential to prevent calculation errors.

Initiate Calculation: Click the "Calculate" button.

Result Verification: Always double-check the calculated total price for accuracy.

Mitigating Risks Associated with CWT Inconsistency

The following risk assessment matrix highlights potential issues and mitigation strategies:

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Conflicting CWT Definitions | High | High | Explicitly define the CWT unit (100 lbs or 112 lbs) in all contracts. |

| Manual Calculation Errors | Medium | Medium | Consistently use a reliable CWT calculator. |

| Data Entry Errors | Medium | Medium | Double-check all data entered into the calculator. |

| Inconsistent Internal Procedures | Low | Medium | Establish clear internal protocols for CWT usage and reporting. |

Best Practices for Accurate Commodity Pricing

Using a CWT calculator is only one aspect of ensuring accurate pricing. These additional best practices are crucial:

Comprehensive Contract Language: Contracts should explicitly state the CWT definition to avoid ambiguity and potential disputes.

Independent Weight Verification: Independently verify the weight of commodities before calculations.

Meticulous Record Keeping: Maintain detailed records of all CWT calculations and related documents for auditing and analysis.

Clear Communication: Open communication with trading partners is vital to ensure everyone understands the chosen CWT definition.

"Accurate commodity pricing is paramount. A small error can lead to substantial financial consequences," states Dr. Anya Sharma, Professor of Agricultural Economics at the University of California, Davis.

International Trade and CWT Inconsistency: Advanced Risk Mitigation

Inconsistent CWT definitions pose significant challenges in international trade. Therefore, comprehensive risk mitigation strategies are vital. These strategies go beyond simply using a CWT calculator.

Step-by-Step Guide to Mitigating International Trade Risks

Select a Globally Recognized CWT Calculator: Choose a calculator validated by international organizations or industry standards.

Contractual Clarity: Explicitly define the CWT definition and calculation methods in all international contracts.

Enhanced Communication: Maintain robust communication with international trading partners throughout the transaction process to ensure complete transparency and understanding.

Pre-Shipment Verification: Conduct thorough pre-shipment inspections to verify the commodity's weight and compare it to the calculated value.

Expanding Risk Management Strategies

Beyond calculations, consider these crucial strategies:

Supply Chain Diversification: Reduce reliance on a single supplier or route to minimize risks from disruptions.

Contingency Planning: Develop detailed contingency plans to address unforeseen issues, such as regulatory changes or supply chain disruptions.

Legal Counsel: Consult legal experts specializing in international trade law to ensure contracts protect your interests.

Insurance Coverage: Explore cargo insurance to mitigate potential losses from unforeseen circumstances.

By implementing these strategies, you can substantially reduce the impact of inconsistent CWT definitions in your commodity pricing and strengthen your international trade operations. Remember, proactive risk management is a key element of long-term success in this industry.